Course: Digital Product Management Industry Project

Team LHV: Külli Kivioja-Ööpik (Digital Product Management micro-credential programme), Shailaja Mahara (Master's in Software Engineering), Mariliis Mieler-Tallo (Conversion Master in IT), Aleksandr Roslin (Digital Product Management micro-credential programme), Henrik Aavik (Digital Product Management micro-credential programme)

Semester: Spring 2024

The challenge

AS LHV Pank is an Estonian-capital-based bank, serving more than 400,000 clients. LHV services for private customers include management of daily financial affairs and home loans. LHV's competitive edge is the best customer experience and offering customers the best options for growing their money. The services for Business customers include flexible and tailored financing solutions and management of daily financial affairs, and the services for financial intermediaries include a single banking platform for both EUR and GBP payments. LHV Pank’s products and services are simple, transparent, and relevant. With a market share of more than 15% in the Estonian daily banking, deposit, and business loan segments, LHV Pank is currently the third largest bank in the daily banking and deposit segments. LHV Pank's long-term goal is to become the largest bank in Estonia, focusing on efficiency, innovation and best-in-class service. With this in mind, the desired change is to encourage and persuade local e-merchants to adopt and implement LHV's payment-acquiring solutions, creating a more cohesive and integrated payment process within the LHV ecosystem.

Process and solution

Students began addressing the challenge by identifying the key stakeholders, including both large and small e-merchants, product managers, business growth managers, and others.

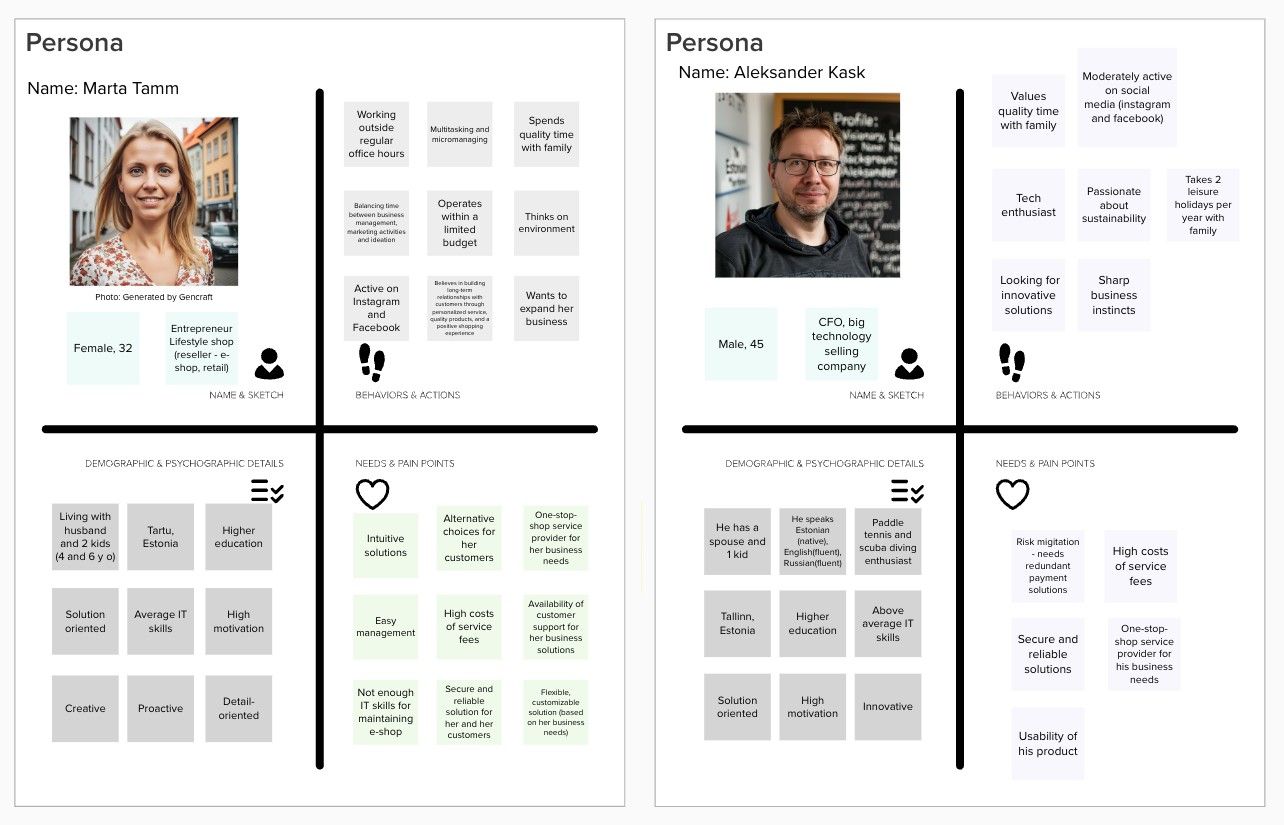

The LHV Team then conducted user research, interviewing both large and small e-merchants to understand their main gains, needs and pain points, and developed two personas accordingly.

Marta Tamm: Reseller who wants to integrate a payment solution into her e-shop.

Aleksander Kask: CFO, big technology selling company.

For Marta, the LHV Team identified needs such as an intuitive solution, alternative choices for customers, and support for limited IT skills in e-shop management, among other concerns. For Aleksander, significant pain points included risk mitigation, the necessity for redundant payment solutions, high service fees, and concerns about security and reliability.

Before proceeding to the ideation phase, the LHV team explored numerous design opportunities using the How Might We (HMW) technique. They considered questions ranging from "HMW highlight the solvable problems to the customers?" to "HMW make the bank feel like a spa, so that the user feels great?"

After careful consideration, the LHV Team decided to focus on the following design opportunity: "How might we showcase the benefits and flexibility of our online payment solution to attract more e-commerce business owners?" With this HMW question in mind, the team brainstormed various possible solutions, including presenting the payment solution as a children's book and developing an AI genie that asks, "What is your wish today?".

I am so overly super-excited about the HMWs and all the ideation methods we used during the project. This is what I didn´t expect at all to learn, but somehow it is one of the biggest new things I take with me.

- Külli Kivioja-Ööpik, student of the Digital Product Management micro-credential programme

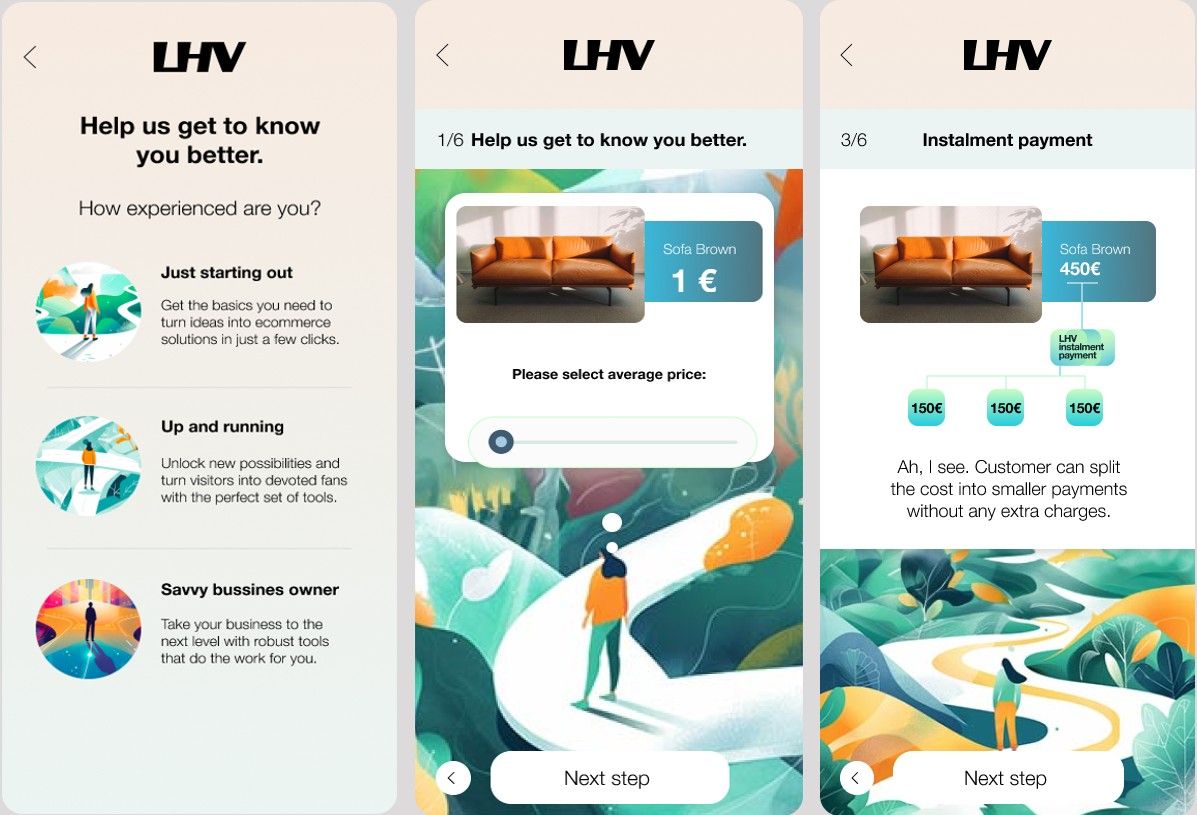

In the end, the LHV team decided to focus on a customizable app tailored to the user's choices. They highlighted the following benefits of this solution:

• Users are asked to provide only the information necessary for preparing the offer and contract.

• Each payment solution is presented visually to ensure it is understandable for everyone.

• Users can sign the contract within a few minutes.

Moreover, the team conducted several rounds of user testing and incrementally improved their solution, ensuring the best user experience for the customers.